Содержание

Уже в обозримом будущем будет исчерпан и такой фактор поддержки обзор торговли февраль 2017, как приток средств на долговой рынок в рамках стратегий carry trade. Суммируя все вышесказанное, можно утверждать, что среднесрочные перспективы российской валюты не так радужны, как на горизонте трех-четырех месяцев. Я считаю, что именно подобные операции поддерживают российский рубль, чтобы он не падал, в последнее время, но этот эффект в скором времени может пропасть, потому что Центральный банк РФ настроен на дальнейшее снижение ключевой ставки.

Если инвесторы обратят внимание на недооцененные российские акции, то это позволит хотя бы сдержать ослабление рубля в конце года. Зависимость от положения дел в других отраслях торговли, например, от стоимости разного сырья. Бюджет страны и формирование запасов сильно зависят от доходов нефтегазовой сферы.

Дополнительно к каждой стратегии необходимо отыскать подход, выработать правила для ее применения, использовать ее сообразно ситуации. На данный момент мировая экономика является относительно стабильной, поэтому Carry Trade снова набирает популярность как у отдельных трейдеров, так и у крупных инвестиционных компаний. В целом риски относительно невелики, поэтому даже не слишком опытный игрок рынка при должной подготовке может попробовать свои силы в данной стратегии. Процентная разница между элементами пары и составляет доход, который трейдер получит уже после совершения сделки. Длительное удержание открытой позиции позволяет использовать весь потенциал затяжных периодов роста данных инструментов.

Cтратегия торговли, при которой продается валюта с низкой процентной ставкой центрального банка одной страны и покупается валюта с высокой процентной ставкой другой страны. Приобретаемая валюта, размещается, на депозите в стране с высокой процентной ставкой. Дорогая нефть (около 72 долларов за баррель сорта Brent) – на максимумах с ноября прошлого года продолжила поддерживать позитивный фон. Высокий спрос на рублевый долг в рамках carry trade и очередной рекорд по объему однодневного размещения ОФЗ Минфином РФ поддерживали российскую валюту. Курс рубля на завершающейся рабочей неделе продолжил повышение в район максимумов с конца марта.

В частности, по мнению уполномоченного при президенте России по защите прав предпринимателей Бориса Титова, на российском валютном рынке на данный момент надулся «пузырь» из-за слишком высокого курса рубля. Произошло это, по мнению Титова, вследствие притока капитала инвесторов, играющих на разнице процентных ставок в различных странах. Такой приток называется carry trade — и, по мнению Бориса Титова, этот «пузырь» может лопнуть, что приведет к резкому падению курса рубля.

Риски кэрри трейда

Без коллапса, прост так на снижении ключевой ставки- выводы не совсем корректны в статье. При шорте фьючерса на доллар на Мосбирже трейдер как раз получает разницу в процентных ставках между рублем и долларом. Во-первых, при расчетах подобных операций обязательно нужно учитывать инфляцию в обеих странах. Мы не будем рассматривать текущие показатели инфляции, потому что из-за кризиса они не очень отражают обычное положение дел, а возьмем докризисные значения. В США официальная потребительская инфляция была в среднем на уровне 2%, а в России 3%.

С начала года рубль среди 24 валют развивающихся рынков показал доходность по операциям carry trade в 7%, подсчитал для «Ведомостей» начальник отдела глобальных исследований «Открытие инвестиций» Михаил Шульгин. Лучше результат только у аргентинского песо, но с точки зрения риска Аргентина уступает России по многим фундаментальным показателям, отмечает он. В результате этой политики мы имеем такой приток спекулятивного капитала в рубль, что его курс уже на 10% превысил обоснованный ценами на нефть уровень.

Наталия Орлова о возможном обвале рубля: «Даже если внешний шок произойдет, движение будет в конце года»

А если считать по старому дедовскому методу, (то есть 3600 рублей за баррель разделить на цену нефти в долларах) то рубль переоценен и вовсе на 21%. Этот метод не всегда применим, но в определённый момент трейдеры начинают считать риски именно так и «выскакивают» из переоцененной валюты. Данилов уточняет, что российские инвесторы (прежде всего институциональные) могут привлекать средства в долларах и затем размещать их в рублях.

При этом прибыль обеспечивает не только разница курсов, но и положительные своп-пункты, а воспользовавшись кредитным плечом можно многократно увеличить выгоду от сделки. Следует учитывать, что Carry Trade несет немало рисков, которые следует учитывать, принимая решение об использовании стратегии. Carry Trade – особая стратегия, позволяющая зарабатывать на фондовом или валютном рынке.

Последние новости мира инвестицийБольше новостей

Это означает, что «очищенная» от инфляции ставка — 1% в США и 3% в России. Многие слышали термин carry trade, но не все понимают, что это такое и каким образом он влияет на российскую национальную валюту. Успешность Carry Trade во многом зависит от политики Центробанков, которые иногда внезапно меняют ставки для управления внутренними экономическими показателями. Поэтому результативность сделок, заключенных по данной стратегии, может колебаться в существенных пределах. У операций carry trade есть второе название — «арбитражные сделки». В-третьих, инвесторы carry trade сталкиваются с финансовыми издержками — налогами, комиссиями.

- Активный метод игры на разнице процентных ставок может быть использован среднесрочными трейдерам и частными инвесторами.

- Предоставленные в Общество персональные данные подлежат уничтожению, либо обезличиванию по достижении указанных целей обработки или в случае утраты необходимости в достижении этих целей.

- Падение остановлено, но остаётся вопрос, как долго будет держаться такая ставка, ведь впоследствии неминуемо будет снижение и новое понижение привлекательности.

- Зависимость от положения дел в других отраслях торговли, например, от стоимости разного сырья.

- Рано или поздно такой цикл приводит к тому, что фондовый рынок начинает снижаться, и средства перетекают в валютные резервы, в том числе и в активы с высокой ставкой.

- Наиболее значительные изменения запускаются под влиянием фундаментальных факторов, способных в короткие сроки повернуть вектор движения на 180 градусов.

В настоящее время ездить никуда не нужно, и подобная стратегия может быть реализована на простом брокерском счёте. Кроме того, при использовании плеча, доходность такой операции может быть увеличена на порядок. Так, например, на момент написания публикации в Австралии основная процентная ставка является одной из самых высоких в мире и составляет 6,25%, а в Японии – самой низкой(0,5%). Можно занять деньги в Японии под половину процента, привезти их в Австралию и разместить под более, чем 6%. И стремится продолжить рост к психологическому уровню 80 рублей за доллар. Правительство уже пытается предпринимать усилия по ослаблению рубля — и покупки, и словесные интервенции, но пока реакция рынка на это не очень серьезная.

Держатели рублевых активов испытали неделю стресса после того, как над российским инвестиционным климатом вновь появился «санкционный риск». https://fx-strategy.info/ вернулись к теме рассмотрения новых ограничений против РФ в рамках «Химического пакета», затронув самый чувствительный сектор — госдолг. Котировки доллара закрепились выше 64 рублей, евро стабилизировался выше 72 рублей. Сейчас ставка ЦБ находится на уровне 6,75%, тогда как в еврозоне она нулевая, а в США – 0,25%, это повышает потенциал российских гособлигаций с точки зрения carry trade. В августе доля вложений нерезидентов на счетах иностранных депозитариев в Национальном российском депозитарии в общем объеме рынка ОФЗ выросла на 1 процентный пункт (п. п.) до 20,9%, говорится в «Обзоре рисков финансовых рынков» ЦБ.

«Известия» узнали новое название «Макдоналдса» в России

Суть стратегии carry tradingсостоит также в покупке исключительно высокодоходных валют против низкодоходных, однако здесь делается упор в первую очередь на курсовую динамику, в предположении роста курса валюты с большей ставкой. Так, в 1998 году высокодоходный доллар рухнул против дешёвой йены за двое суток на 17%. Западные банки рекомендуют своим клиентам начинать выходить из рублевых бумаг и переходить в другие валюты развивающихся стран. Однако, по мнению отечественных аналитиков, спешить сворачивать операции carry trade пока рано и они еще достаточно долго будут прибыльными. Благодаря высоким ставками в России спекулянтам кэрри-трейдерам не страшно даже снижение цен на нефть. Зато после снижения ставок ЦБ можно сразу получить обвал рубля на завершении carry trade, а затем — и новый скачок инфляции.

В случае падения валюты с большей ставкой по отношению к менее доходной валюте более чем на разницу процентных ставок, стратегия будет убыточной. Но относительно текущих цен на нефть, от которых в максимальной мере зависит российский платежный баланс, курс рубля немного завышен. Более стабильные уровни для курса USD/RUB при текущих ценах на черное золото лежат в районе 62—63. В случае же снижения цен на нефть эти уровни могут передвигаться в район 67—69. Катализатором снижения рубля может быть локальное усиление глобальных рисков и коррекция цен на нефть.

В противном случае можно очень быстро потерять и без того не большой депозит. Необходимо помнить, что абсолютно безрисковых или простых стратегий на финансовом рынке не существует. Чем выше потенциальная прибыль, тем серьезнее последствия в случае неудачи. Но рисками можно управлять, например, размещая ордера стоп-лосс или отказавшись от использования большого кредитного плеча. «Россия вступает в 2020 год с резервом более чем в полтриллиона долларов и одной из самых прибыльных в мире валют для carry trade».

Рубль подогревает интерес к carry trade

Это может привести к очередному бегству иностранных инвесторов из российских государственных облигаций, потому что, как видно из моего примера выше, разница в ставках уже сейчас не очень большая, а в ближайшем будущем она и вовсе может пропасть. Также при падении курса национальной валюты (рубля) иностранный инвестор потеряет свой доход, и подобные операции становятся для него невыгодными. Именно по этой причине в случае негатива в экономике РФ мы имеем огромный отток иностранных инвесторов из наших ОФЗ.

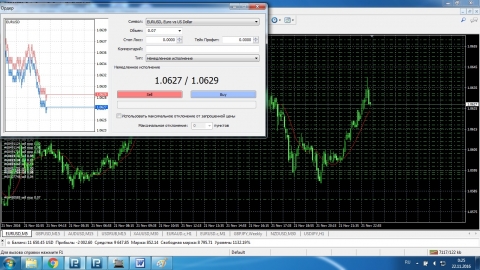

В итоге курсы приближались к круглым отметкам 64 рубля за доллар и 73 рубля за евро. В общем, перед тем, как принимать решение зарабатывать, таким образом, нужно на сайте брокера или в самом терминале посмотреть величину свопа по выбранной паре. Это позволит точно понимать, сколько денег будет приносить carry trade. Начисление происходит при переносе позиции на следующие торговые сутки, для России это около часа ночи по московскому времени в зимнее время и полночь в летнее.

.jpeg)