In the securities industry, the commerce settlement period refers back to the time between the trade date—month, day, and 12 months that an order is executed out there—and the settlement date—when a trade is considered last. National Securities Clearing Corporation is a subsidiary of Depository Trust & Clearing Corporation that provides centralized clearing, threat administration, information and settlement services to the financial industry. The NSCC presents multilateral netting so that brokers can offset purchase and promote positions into a single cost obligation. NSCC also nets trades and funds amongst its members, lowering the worth of securities and payments that need to be exchanged by a median of 98% every day. DTCC Derivatives Repository Ltd.Website Depository Trust & Clearing Corporation is an American submit-commerce financial services firm providing clearing and settlement services to the financial markets.

In this case, the clearinghouse receives cash from the buyer and securities or futures contracts from the vendor. Established in 1973, it was created to reduce costs and provide efficiencies by immobilizing securities and making “book-entry” changes to show ownership of the securities. DTC moves securities for NSCC’s net settlements, and settlement for institutional trades (which typically involve money and securities transfers between custodian banks and broker-dealers), as well as money market instruments. In 2007, DTC settled transactions worth $513 trillion, and processed 325 million book-entry deliveries. In addition to settlement services, DTC retains custody of 3.5 million securities issues, worth about $40 trillion, including securities issued in the United States and more than 110 other countries.

The second response involves multilateral netting; and led to the formation of the National Securities Clearing Corporation in 1976. The Fixed Income Clearing Corporation is an agency that deals with the confirmation, settlement and delivery of fixed-income assets in the U.S. See what our clients say about our service, in-depth understanding, and timely deliveries. Our Integrated E-commerce Logistics is an end-to-end solution specifically designed for e-commerce companies who need quick and reliable logistics to gain a competitive edge.

DTCC Learning provides financial, technology, and career training and educational services to the global financial industry. Today, all physical shares of paper stock certificates are held by a separate entity, Cede and Company. Established in 1973, The Depository Trust Company was created dtcc india to alleviate the rising volumes of paperwork and the lack of security that developed after rapid growth in the volume of transactions in the U.S. securities industry in the late 1960s. These include white papers, government data, original reporting, and interviews with industry experts.

India Dictionary

In 2017, DTCC’s subsidiaries processed securities transactions valued at greater than U.S. $1.sixty one quadrillion. Its depository offers custody and asset servicing for securities points from 131 nations and territories valued at U.S. $fifty seven.four trillion. EuroCCP began operations in August 2008, initially clearing for the pan-European trading platform Turquoise. EuroCCP has subsequently secured appointments from additional trading platforms and now provides central counterparty services for equity trades to Turquoise, SmartPool, NYSE Arca Europe and Pipeline Financial Group Limited.

Federal Reserve System, the DTC provides settlement services, asset servicing, and clearing services. Discover our rich history of serving and advancing the financial markets for over 45 years. See how DTCC’s risk management framework helps protect the industry from an array of threats. Omgeo – Omgeo is a central information administration and processing hub for broker-sellers, funding managers, and custodian banks.

- The SEC’s new rule amendment reflects improvements in expertise, increased trading volumes and modifications in funding products and the trading panorama.

- DTCC is the world’s largest financial companies corporation dealing in post-commerce transactions.

- Taking 24-hours out of the settlement cycle represents significant challenges and will require firms across the globe to make both operational and technical changes across the trade lifecycle.

- FICC was created in 2003 to handle fixed income transaction processing, integrating the Government Securities Clearing Corporation and the Mortgage-Backed Securities Clearing Corporation.

- Its depository offers custody and asset servicing for securities points from 131 nations and territories valued at U.S. $fifty seven.four trillion.

Today, DTCC employs over 4,300 staff globally, with almost 1,400 in Jersey City alone. NTCP has resulted in provision of dedicated funds and manpower for implementation of the Programme. STCC and DTCC Plan have been subsumed in the Flexi-pool for Non- Communicable Disease under National Health Mission for effective implementation since 12th Five Year Plan.

How many employees does DTCC have?

Such transactions encompass futures, options contracts, stock and bond trades, and marginmoney. In addition, clearing corporations have a range of tasks including regulating the supply of securities and reporting buying and selling knowledge. In real property, settlement is the formal means of transferring the title of the real estate from the seller to the customer. Also through the settlement course of, a lien is utilized in opposition to the property for the advantage of the mortgage lender. Participants in this market embody mortgage originators, government-sponsored enterprises, registered dealer-sellers, institutional investors, funding managers, mutual funds, commercial banks, insurance companies, and other financial establishments. National Securities Clearing Corporation is a subsidiary of the Depository Trust & Clearing Corporation that gives centralized clearing, threat management, information and settlement companies to the monetary industry.

For the move to T+1 settlement for transactions in U.S. cash equities, corporates debt, and unit investment trusts. Taking 24-hours out of the settlement cycle represents significant challenges and will require firms across the globe to make both operational and technical changes across the trade lifecycle. Today, we stand at the center of global trading activity, processing trillions of dollars of securities transactions on a daily basis. They achieve this by taking offsetting positions with clients in each transaction. Then in 1993, the SEC changed the settlement period for many securities transactions from five to 3 enterprise days—which is named T+three.

DTC

Industry owned and governed, the firm simplifies the complexities of clearing, settlement, asset servicing, data management, data reporting and information services across asset classes, bringing increased security and soundness to financial markets. In 2021, DTCC’s subsidiaries processed securities transactions valued at nearly U.S. $2.4 quadrillion. Its depository provides custody and asset servicing for securities issues from 177 countries and territories valued at U.S. $87.1 trillion. DTCC’s Global Trade Repository service, through locally registered, licensed, or approved trade repositories, processes 16 billion messages annually. To learn more, please visit us at or connect with us on LinkedIn, Twitter, YouTube, Facebook, and Instagram.

Depository Trust & Clearing Corporation: DTCC and National Securities Clearing Corporation (NSCC)

EuroCCP clears trades in more than 6,000 equities issues for these trading venues. In October 2009, EuroCCP began clearing and settling trades made on the Turquoise platform in 120 of the most heavily traded listed Depositary Receipts. The first response was to hold all paper stock certificates in one centralized location, and automate the process by keeping electronic records of all certificates and securities clearing and settlement . Continuous Net Settlement is an automated book-entry accounting system used by the NSCC for the clearing and settlement of securities transactions. The DTCC is the parent institution of the Depository Trust Company , a securities depository.

A trade is deemed compared by the MBSD on the time limit at which the division makes available to the members on each side of a transaction output indicating that their trade data have been in contrast. Investors who make a number of transactions in a day can generate significant fees. Specifically, in the case of futures contracts, clearing fees can pile up for investors as lengthy positions unfold the per-contract charge out over an extended time period. Along with NSCC, DTCC manages an additional 4 clearing corporations and one depository. DTCC is the world’s largest financial companies corporation dealing in post-commerce transactions. DTCC created Deriv/SERV LLC In 2003 to help resolve over the counter derivatives challenges of the time.

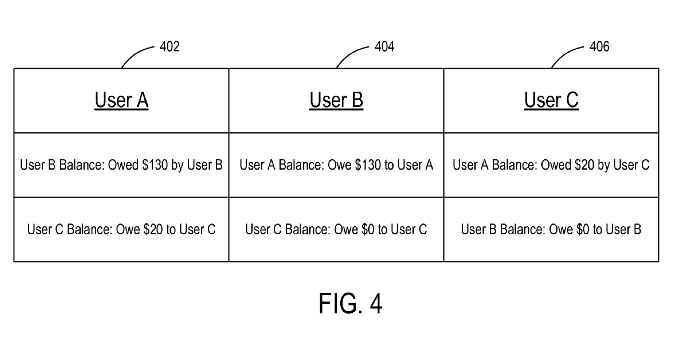

The process for transferring securities also relied heavily on physical recordkeeping. After the NSCC has processed and recorded the trade, they provide a report to the brokers and financial professionals involved. This report includes their net securities positions after the trade and the money that is due to be settled between the two parties. The Express Parcels Vertical offers a wide range of domestic products and services catering to C2C and B2B customers for documents and parcels of all sizes including part-truck-load shipments… DTCC Learning empowers you with the knowledge and skills you need to make most of your investments in DTCC’s robust range of leading financial services solutions. Forbes awards the designation based on standards that includes creating a working environment the place workers really feel happy, impressed and nicely-compensated.

For its subsidiaries, including the Depository Trust Company and the National Securities Clearing Corporation , it oversees operations and manages financial risks. Now, most on-line brokers require traders to have enough funds of their accounts earlier than buying stock. Also, the trade now not points paper inventory certificates to characterize ownership. Although some inventory certificates nonetheless exist from the past, securities transactions right now are recorded nearly completely electronically utilizing a process known asbook-entry; and electronic trades are backed up by account statements. Responsibilities embody settling buying and selling accounts, clearing trades, amassing and sustaining margin monies, regulating delivery of the bought/bought instrument, and reporting buying and selling data. Clearing houses act as third events to all futures and options contracts, as patrons to each clearing member vendor, and as sellers to each clearing member purchaser.

During the settlement period, the buyer must pay for the shares, and the seller must deliver the shares. On the final day of the settlement period, the customer turns into the holder of document of the security. Through both divisions, the Fixed Income Clearing Corporation helps to make sure that US government-backed securities and mortgage-backed securities are systematically and effectively settled. Treasury notes and bonds decide on a T+1 foundation, while Treasury payments settle at T+0. Given the consolidated timeframes on trade date, there is very little leeway for delays and firms should take that into account as they go through their development and testing plans.

DTCC will also be making its PSE-A region available in June for T+2 testing, as well as any testing of services not impacted by the transition to a T+1 settlement cycle. Team can help firms identify and implement the right control and process enhancements, benchmark performance against peers, address settlement fails, manage product implementation, revamp technical architecture, optimize overall trade processing operations, and more. Most large U.S. broker-dealers and banks are full DTC participants, meaning that they deposit and hold securities at DTC. DTC appears in an issuer’s stock records as the sole registered owner of securities deposited at DTC. DTC holds the deposited securities in “fungible bulk”, meaning that there are no specifically identifiable shares directly owned by DTC participants. Rather, each participant owns a pro rata interest in the aggregate number of shares of a particular issuer held at DTC.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. DTCC, through its subsidiaries, advances industry-leading solutions that help secure and shape the future growth and development of the global financial marketplace. A centralized source of information about the industry’s effort to accelerate the U.S. securities settlement cycle to T+1 in 2024.

To keep pace with the demands of the industry and our clients, our dedicated employees work in a highly collaborative environment, as they consistently develop solutions to mitigate risk, create efficiencies and reduce costs. We are adding and updating information about hundreds of thousands of companies every day, and periodically add companies to the queue for being updated. You can ask for a company to be added to the front of the queue for updating, especially useful if the address, directors, or other critical information has changed. With forty five years of experience, DTCC is the premier publish-trade market infrastructure for the global monetary providers trade. Co-ordination with Panchayati Raj Institutions for inculcating concept of tobacco control at the grassroots. ” series, launched last year, explores the impact of accelerated settlement and T+1 on specific industry segments.