Contents

That way, you can use the rest of your time and energy working on your patience and discipline. One of the best ways to develop the skills you need is to read as much as you can and learn from the experts themselves. To help you get started,Fair Forex has compiled a list of the best trading books every novice trader should read. It has given you an understanding of what is involved in trading in Forex.

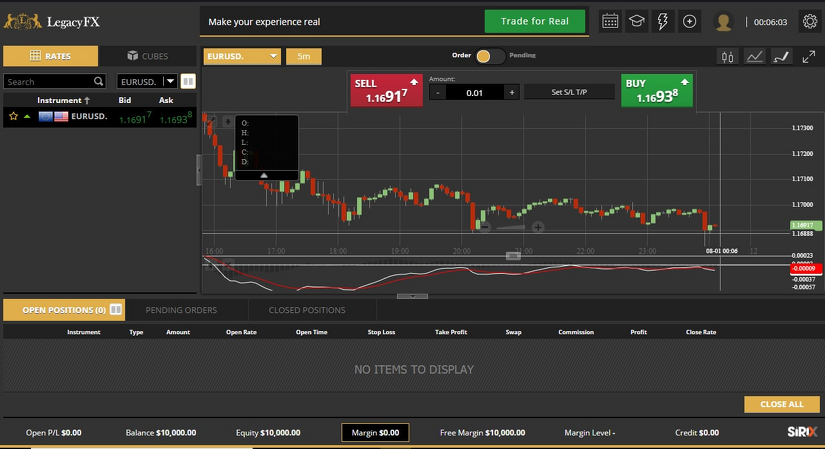

Forex day traders buy and sell multiple currency pairs within the same day, or even multiple times within a day, to take advantage of small market movements. After that, find out how to get started as an account holder with a reputable broker and start buying and selling foreign currency on your own. Most beginners use demo accounts to learn the ropes and gain a complete understanding of how to place orders, set stops, and exit positions when the time is right.

What Is the Forex Market?

You will have to be patient and treat this as a new subject to learn. The book will teach you a reliable system to earn money in the market, the key strategies, and capital management. As you may learn over time, nothing beats experience, and if you want to learn forex trading, experience is the best teacher. When you first start out, you can open a forex demo account and try out some dry-run trading. It will give you a good technical foundation on the mechanics of making forex trades, as well as help you get used to working with a specific trading platform.

For example, those that traded this pair managed to achieve huge payouts in the past. This encourages new traders to try it themselves, only to find out that the “good past” had its reasons, and those reasons are now gone. Trading currencies that a trader knows nothing about is usually considered a bad idea. You see, when a trader has nothing to lose, they are in a completely different mood.

However, traders can avoid that pitfall by opting to work with a reputable and well-known broker. Trading instruments – When it comes to trading currency pairs, there are a lot of different options for you. You might also want to eventually trade stocks and other instruments so make sure that the broker has all these tools available before choosing one. Although the pin bar trading strategy is my favorite, I have had some of my largest trades using the Forex breakout strategy above. The market will often react quite aggressively after the breakout occurs, allowing traders to secure a large profit in a relatively short period of time. But no matter if you’re a beginning trader or you’ve been trading for years, there are a few price action trading strategies that you should always keep in your back pocket.

This currency is bought or sold in exchange for the quote currency and is always worth 1. Trading forex is risky, so always trade carefully and implement risk management tools and techniques. The “bid” for the currency pair will tell you the amount of quote currency you’ll need in order to obtain the base currency. In this pairing, the first listed currency is referred to as the base currency, while the second currency is referred to as the quote currency. The currency pair will indicate the amount of the quote currency you’ll need in order to purchase one unit of the base currency. You can easily conduct the trades in major financial centers of London, New York, Zurich, Paris, Tokyo, Singapore, Sydney, and Hong Kong – across almost every time zone.

Day Trading

One of the primary Forex trading lessons for beginners is that fearing risk is an advantage and not an issue. This advantage is only gained through putting something you own on the line. Forex may be a market that is mostly influenced by supply mash certified sober homes and demand, but it also changes according to what’s going on in the world. When the UK first announced that they were leaving the European Union, a lot of traders believed that it would hurt the economy, so they started selling a lot of GBP.

You can trade forex via a spread betting or CFD trading account via desktop or mobile devices. Besides forex, you can access to thousands of financial instruments, including indices, cryptocurrencies, commodities, shares, ETFs and treasuries. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

The formations and shapes in candlestick charts are used to identify market direction and movement. Some of the more common formations for candlestick charts are hanging man and shooting star. If you are living in the United States and want to buy cheese from France, then either you or the company from which you buy the cheese has to pay the French for the cheese in euros . This means that the U.S. importer would have to exchange the equivalent value of U.S. dollars for euros. Diane Costagliola is an experienced researcher, librarian, instructor, and writer. She teaches research skills, information literacy, and writing to university students majoring in business and finance.

What is Forex Trading and How Does it Work

All three of these have their advantages and disadvantages, but let’s focus on some tried and tested strategies. In this chapter we’ll go through a worked example of a spread bet in EUR/USD. There are four traditional majors – EURUSD, GBPUSD, USDJPY and USDCHF – and three known as the commodity pairs – AUDUSD, USDCAD and NZDUSD. It is the smallest possible move that a currency price can change which is the equivalent of a ‘point’ of movement.

On the other hand, let’s say you’ve just graduated and you want to generate a consistent income from trading. Maybe you want to get into the proprietary trading industry or work for a prop firm. I want you to absorb as much as you can, be it through reading books, podcasts, or blogs whatsoever.

The first step to forex trading is to educate yourself about the market’s operations and terminology. Next, you need to develop a trading strategy based on your finances and risk tolerance. Today, it is easier than ever to open and fund a forex account online and begin trading currencies. The forex market is traded 24 hours a day, five and a half days a week—starting each day in Australia and ending in New York.

Alternatively, when selling a currency pair, you are expecting the base currency to depreciate against the counter currency. A trade requires two currencies in which the first currency is known as the “base currency”, and the second currency is known as the “quote currency”. A forex trade involves the simultaneous buying of one currency and selling of another.

Ways to trade forex

However, you should also be familiar with the characteristics of the currency you are buying. For example, the Australian Dollar will benefit from rising commodity prices, the Canadian Dollar has a positive correlation with oil prices and so on. To use moving average crossovers , you will have to set a fast MA and a slow MA.

The foreign exchange market, more commonly known as forex or FX, is famous for being one of the most exciting markets that exist in this day and age. The foreign exchange market is one of the most well-known markets in today’s financial industry. Whatever your level of trading experience, it’s crucial to have access to your open positions. A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time. For this right, a premium is paid to the broker, which will vary depending on the number of contracts purchased.

In addition to its attractive trading conditions, beginners will find Tickmill’s education section a welcoming experience. Tickmill offers a free 46-page ebook titled The Majors – Insights & Strategies, a well-illustrated resource explaining Forex Trading Basics and how Forex trading works. It also runs frequent webinars in four languages and runs seminars around the world. Overall, Tickmill is a good choice for beginner traders looking for good trading conditions and educational support.

This means that if you decide to switch broker your trading platform, with any customisations you may have made, can move with you. This is because the Forex market is not a physical market, it is a virtual market made up of a network of computers all over the world. This network connects traders to other market participants, such as banks and other brokers. Understand how high-qualitycustomer supportcan improve life for beginner traders.

Most traders, however, use third-party trading platforms that need to be downloaded to their computer. This is the difference between the buy and sell price of a trading asset and is measured in pips (the 5thdecimal place of an asset’s price). Brokers will artificially widen the spread from the original market price of an asset. Unregulated brokers will often claim to be regulated, so you should always check what they say is true. We know that unregulated brokers like to contact people on Facebook and via messaging apps, so be especially careful if this happens. Many unregulated brokers will often entice beginner traders with incredible profits, offering to double or triple their money within weeks.

Beginners should ensure they understand all risks fully before undertaking margin trading. A relatively small collateral deposit is required in order to initiate much larger traded positions in the market. Aggressive investors are attracted by the obr forex volatility of the Forex market and the opportunity for substantial profits, particularly when using leverage. Towards the bottom, you will see one of the most popular and frequently asked questions, which relates to margin FX trading examples.

EDUCATION

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. AxiTrader is 100% owned by AxiCorp Financial Services Pty Ltd, a company incorporated in Australia . Over-the-counter derivatives are complex instruments and come with a high risk of losing substantially more than your initial investment rapidly due to leverage. You should consider whether you understand how over-the-counter derivatives work and whether you can afford to take the high level of risk to your capital.

Which forex pairs pay the most?

- EUR/USD (euro/US dollar)

- USD/JPY (US dollar/Japanese yen)

- GBP/USD (British pound/US dollar)

- AUD/USD (Australian dollar/US dollar)

- USD/CAD (US dollar/Canadian dollar)

- USD/CNY (US dollar/Chinese renminbi)

- USD/CHF (US dollar/Swiss franc)

- USD/HKD (US dollar/Hong Kong dollar)

It also provides an unlimited demo account for beginner traders to practice trading without risking real money, and excellent customer service to help with account setup and technical queries. This book provides a good introduction to forex market forces, currency quotes, and the various types of forex brokers and their systems. By combining the basics of forex trading with in-depth risk analysis, beginner traders can effectively minimize risk and ensure steady revenue. The value of a currency pair is influenced by trade flows, economic, political and geopolitical events which affect the supply and demand of forex. This creates daily volatility that may offer a forex trader new opportunities. Online trading platforms provided by global brokers like FXTM mean you can buy and sell currencies from your phone, laptop, tablet or PC.

Customer Support

Into their strategy, which leads to information overload and conflicting signals. You can always tweak your strategy as you go and use the experience you learnt from backtesting and demo trading. Most scalpers will close positions before the end of the day, because the smaller profit margins from each trade will quickly get eroded by overnight funding charges. OurState of the Market ReportandBroker Directoryare the result of extensive research on over 100 Forex brokers. The explicit goal of these resources is to help traders find the best Forex brokers – and steer them away from the worst ones – with the benefit of accurate and up-to-date information.

How to Choose a Trading Market

Currencies are traded in pairs so if you think the pair is going higher, you could go long and profit from a rising market. However, it is vital to remember that trading is risky, and you should never invest more capital than you can afford to lose. As a leading global broker, we’re committed to providing flexible services tailored to the needs of our clients. As such, we are proud to offer the most popular trading platforms in the world – MetaTrader 4 and MetaTrader 5 . Our traders can also use the WebTrader version, which means no download is required, while the MT apps for iOS and Android allow you to trade the markets on the go, anytime and anywhere. Most online brokers will offer leverage to individual traders, which allows them to control a large forex position with a small deposit.

The Forex market is filled with hundreds of different trading strategies, but what are the best Forex trading strategies for beginners? This is a common question among traders just starting out and for good reason. In this book, you will learn all the basic information you need to start understanding foreign exchange currencies, fibonacci strategy forex and how to trade them. You will learn exactly what Forex is, and why you should dabble in the art of trading it. You will learn about the risk vs. the reward, and much, much more. All lined out with clear and concise instructions, tips, and other indicators to make this book simple and enjoyable to listen to.

To better understand why these are so important we will look at all three in detail below. Some traders use Technical Analysis to look at the patterns of trading in the market and identify trends to indicate levels of supply and demand in the market. The idea is to identify the right time to enter and exit the market based on trends in the data.